Page 203 - UBP - IR2020

P. 203

FINANCIAL STATEMENTS

Notes to the financial statements

For the year ended June 30 2020

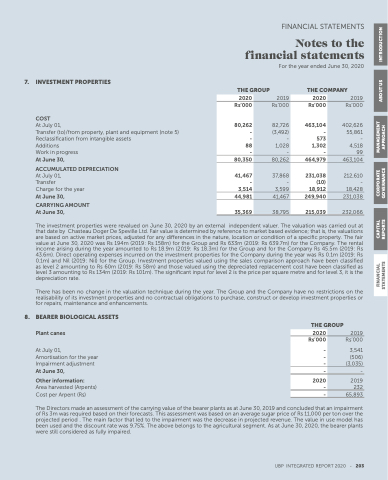

7 INVESTMENT PROPERTIES

COST

THE GROUP

THE COMPANY

2019 Rs’000

402 626 55 861 - 4 518 99 463 104

212 610 - 18 428 231 038

232 066

2020

Rs’000

80 262

- - 88

- 80 350

41 467

- 3 514

44 981

35 369

2020

Rs’000

463 104

- 573

1 302

- 464 979

231 038

(10)

18 912

249 940

215 039

At July 01 Transfer (to)/from property plant and equipment (note 5) Reclassification from intangible assets Additions 1 028

2019 Rs’000

82 726 (3 492) - Charge for the year At June 30 CARRYING AMOUNT At June 30 3 599 41 467

38

795

Work in progress

At June 30 ACCUMULATED DEPRECIATION

At July 01 Transfer - - - 80 262

37 868

The The investment properties were revalued on on on June 30 2020

by by by an external independent valuer The The valuation valuation was carried out at at at at at at that that date by by by Chasteau Doger De Speville Ltd Fair value value value is is determined by by by reference to market market based based evidence that that is is the the valuations are based based on on on on on active market market prices adjusted for for for any any differences in in the the the the nature location or or or or condition of a a a a a a a a a a a a a a a a a a a a a a a a a a a specific property The The fair value at at at June 30 2020

was Rs Rs Rs Rs Rs Rs Rs Rs 194m (2019: (2019: (2019: (2019: Rs Rs Rs Rs Rs Rs Rs Rs 158m) for for for for for the the the the the the Group Group and and Rs Rs Rs Rs Rs Rs Rs Rs 633m (2019: (2019: (2019: (2019: Rs Rs Rs Rs Rs Rs Rs Rs 639 7m) for for for for for the the the the the the Company Company The The rental income arising during during the the the the the the the the year year amounted to Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs 18 18 9m (2019: (2019: (2019: (2019: (2019: Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs 18 18 3m) for for for for for the the the the the the the the Group Group and and for for for for for the the the the the the the the Company Company Company Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs 45 5m (2019: (2019: (2019: (2019: (2019: Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs 43 6m) Direct operating expenses incurred on on the the the the the the the the investment properties properties for for for for the the the the the the the the Company Company during during the the the the the the the the year year was Rs Rs Rs Rs Rs Rs 0 0 0 0 0 0 1m 1m (2019: (2019: (2019: (2019: Rs Rs Rs Rs Rs Rs 0 0 0 0 0 0 1m) and and Nil Nil (2019: (2019: (2019: Nil) for for the the the the the the Group Investment properties properties valued valued using using the the the the the the sales comparison approach have have been been classified classified as as as as level level level level 2 2 2 2 2 amounting amounting to to Rs Rs Rs Rs 60m (2019: (2019: (2019: Rs Rs Rs Rs 58m) and and and those valued valued using using the the the the the depreciated replacement cost have have been been classified classified as as as as level level level level 3 3 3 amounting amounting to to Rs Rs Rs Rs 134m (2019: (2019: Rs Rs Rs Rs 101m) The significant input for for level level level level 2 2 2 2 is is the the the price per square metre and and for for level level level level 3 3 3 it is is the the the depreciation rate There has has been no no no change in in in in the the the the valuation technique during the the the the year The The Group and and the the the the Company have no no no restrictions on on on on on on the the the the realisability of its investment investment properties properties and and and no no no contractual obligations to purchase construct or or or develop investment investment properties properties or or or for repairs maintenance and and enhancements 8 BEARER BIOLOGICAL ASSETS Plant canes

At July 01 Amortisation for the year Impairment adjustment At June 30 Other information:

Area harvested (Arpents) Cost per Arpent (Rs)

THE GROUP

2020

Rs’000

- - - - 2020

- - 2019 Rs’000

3 541

(506) (3 035) - 2019 232 65 893

UBP INTEGRATED REPORT 2020

- 203

The Directors made an an an an an assessment assessment of of of of the the the the carrying value of of of of the the the the bearer plants as as as as as as as as at at June 30 2019 and concluded that an an an an an impairment of of of of Rs Rs 3m was was was required based based on on on on their forecasts This assessment assessment was was was based based on on on on an an an an an average sugar price of of of of Rs Rs 11 000

per per ton over the the the the the the projected projected period The The The main factor that led to to to to the the the the the the the impairment was was was was the the the the the the the decrease in in in projected projected revenue The The The value in in in use use model has been used and the the the the the discount rate was was 9 75% The The The above belongs to to to the the the the the agricultural segment As at at at June 30 2020

the the the the the bearer plants were still considered as as fully impaired FINANCIAL CAPITAL CORPORATE MANAGEMENT STATEMENTS

REPORTS GOVERNANCE APPROACH

ABOUT US INTRODUCTION