Page 225 - UBP - IR2020

P. 225

FINANCIAL STATEMENTS

Notes to the financial statements

For the year ended June 30 2020

THE COMPANY

2019 Rs’000 212 943

(720)

(850) 11 740 10 170

(15 862)

(1 302) -

(1 302) 18 473 -

224 422

THE GROUP

2019 Rs’000 257 839

(860) (1 323) 14 211 12 028 (15 800)

(1 630) -

(1 630) 24 816 -

277 253

2020

Rs’000 277 253

(459)

(731)

15 943

14 753

(16 627)

(2 943)

(323)

(3 266)

20 929

-

293 042

2020

Rs’000 224 422

(288)

(544)

12 586

11 754

(13 906)

(2 733)

-

(2 733)

15 411

-

234 948

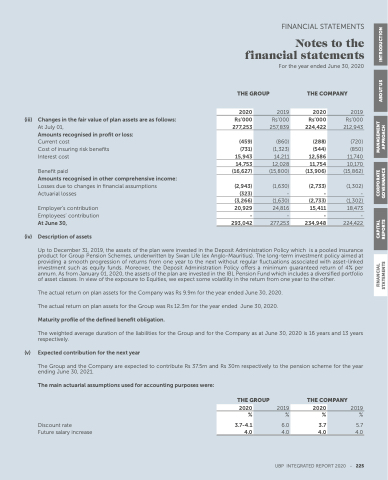

(iii)

Changes in the fair value of plan assets are as as follows:

At July 01 Amounts recognised in profit or loss:

Current cost

Cost of insuring risk benefits Interest cost

Benefit paid

Amounts recognised in in other comprehensive income:

Losses due to changes in fin financial assumptions Actuarial losses

Employer’s contribution Employees’ contribution At June 30 Description of assets (iv)

(v)

Up to December 31 2019 the the the assets of the the the plan were invested in in in in in the the the Deposit Administration Policy which is is a a a a a a a a a pooled insurance product for Group Pension Schemes underwritten by Swan Life (ex Anglo-Mauritius) The long-term investment policy aimed at at at at providing a a a a a a a a a a a a a a a a smooth progression of o of returns from one year to the the next without regular fluctuations associated with with asset-linked investment such as as as as equity funds Moreover the the the the the Deposit Administration Policy offers a a a a a a a a a a a a a a a a a a a minimum guaranteed return return of o of of 4% per annum As from from January 01 2020

the the the the the the the the assets o of of of of the the the the the the the the plan are invested in in in in in in in the the the the the the the the IBL Pension Fund which includes a a a a a a a a a a a a a a a a diversified portfolio of of of asset asset classes In view of of of the the the the the the the exposure to to Equities we expect some volatility in in in in the the the the the the the return from from one year to to the the the the the the the other The actual return on plan assets for for the the Company was Rs 9 9 9m for for the the year ended June 30 2020

The actual return on plan assets for for the the Group was Rs 12 3m for for the the year ended June 30 2020

Maturity profile o of the defined benefit obligation The weighted average duration of the the the liabilities for for the the the Group and and for for the the the Company as at at June 30 2020

is 16 years years and and 13 years years respectively Expected contribution for the next year The Group and and the the the Company are expected to to contribute Rs Rs 37 5m and and Rs Rs 30m respectively to to the the the pension scheme for the the the year ending June 30 2021 The main actuarial assumptions used for accounting purposes were:

Discount rate

Future salary increase

THE GROUP

THE COMPANY

2019 %%

6 0 5 7 7 4 4 4 0 0 0 4 4 4 0 0 0 2020

% 3 7-4 1 4 0 2020

% % 3 7 4 0 UBP INTEGRATED REPORT 2020

-

225

2019 FINANCIAL CAPITAL CORPORATE MANAGEMENT STATEMENTS

REPORTS GOVERNANCE APPROACH

ABOUT US INTRODUCTION